A penny saved is a penny earned. – Benjamin Franklin

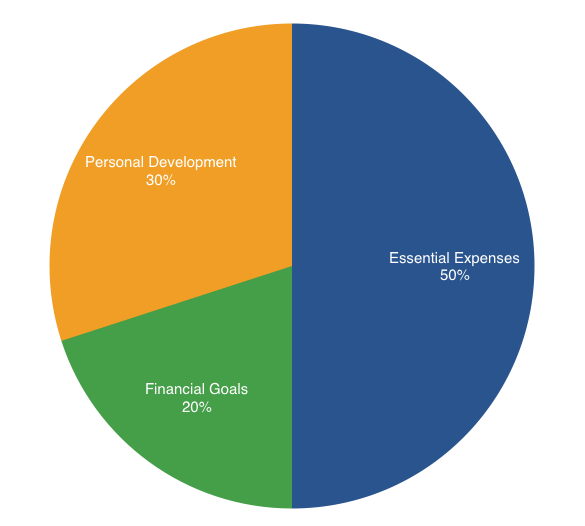

What’s the 50/20/30 rule anyway? It’s a method for breaking down your personal budget that was made popular by Elizabeth Warren’s book “All Your Worth: The Ultimate Lifetime Money Plan“. 50/20/30 rule can be used as a guideline for running your business. It works because it’s easy to learn and apply. It’s broken down into these three areas; essential expenses, financial goals and personal development.

Essential Expenses

Essential expenses should not exceed 50% of what you earn. 50% is what’s needed to run your day to day business, it’s critical to keep your business going. From this portion of your budget, you will pay your monthly bills such as your rent, salaries, internet, phone and light bills.

So, if you work in a high-rent area, such as New Kingston or Liguanea you could spend 50 percent or more on rent alone. You may consider

-

sharing office space with another entrepreneur

-

using a co-working space

-

working from a café shop with free Wi-Fi

-

working from home until the business can afford this expense

Another option is to reduce your personal development spending to balance your books. But more on this later.

Financial Goals

20% of what you earn should go to your financial goals budget. Do you have a financial goal for your business? Hey, listen, you must have some kind of goal for your company. How are you going to expand? How are you going to grow it? It’s about investing the income that you have to grow the business.

If you have loans, you may consider using these funds to reduce your debt. Let’s say you want to earn $50 million dollars in 3 years, you should also consider investing your money in:

-

Certificate of Deposits

-

Stocks

-

Bonds

-

Mutual Funds

If you are a solo entrepreneur you may want to consider investing in a retirement plan.

Personal Development

The final 30% is for self-care. By this, I mean your personal or business development. Use it as a way to enjoy the perks of running your own business.

Have you considered traveling to a business conference or networking event? Maybe dinner at that fancy restaurant with your top clients or business associates (remember to keep the receipt it’s a deductible expense for your income tax returns)?

You may want to drive a nicer car, refurbish the office, travel business or first class. Do you want to wear custom suits vs branded polo shirts? Do it. It’s about enjoying the perks of being the owner.

If you are not spending 30% on your personal development budget put the excess back to your financial goals.

How does this all work?

Let’s take a look at John and Jane, operators of JJ’s Pro Services, which earns $10,000,000 per year. And let’s assume that they pay 25% out in corporate income tax. John and Jane now have $7,500,000 (625,000) per month left to run the business. The Essential Expenses for this business would be $312,500.00, with Financial Goals coming in at $125,000.00 and Personal/Business Development rounding out at $187,500.00.

For JJ’s budget, a typical month for the upcoming year might look like this:

Essential Expenses

| Rent | $80,000 |

| Office Supplies | $11,000 |

| Utilities | $56,000 |

| Internet | $19,000 |

| Staff | $145,000 |

| Total | $311,000 |

Financial Goals

| Replace Computers |

$40,000 |

| Debt Repayment |

$65,000 |

| Savings |

$20,000 |

| Total |

$125,000 |

Personal Development

| Training |

$50,000 |

| VIP Client Meetings |

$25,000 |

| Overseas Conference / Networking |

$110,000 |

| Total |

$185,000 |

How To Get Started With 50/20/30 rule for your budget – Answer these 3 big questions

-

How much is your business earning? The 50/20/30 rule should help you determine what is going on with your finances. Remember that your earnings will fluctuate every month, so always base your budgeting on your average monthly income.

-

What are you spending money on? Ensure that your spending makes sense for your income level. Pay close attention to your statements – bank, credit, debit cards and use it as a good opportunity to track all your spending. Don’t forget that the sushi lunch with co-workers or that afternoon glass of wine at Sovereign North can quickly add up. Consider your mobile data for example. Are you paying for overages on your plan? If you find that you are overspending, find a way to cut back. And if find that you are underspending, use that extra money to realize your financial goals. Focus on reducing your debt payment or invest more.

-

What are you doing to grow your business? HeadOffice will help you manage the budget for your business.

Do you use a specific budgeting method that has been successful in your business? Let us know what has worked for you in the comments below.